A Simple Attempt to Trade EEM

- "…The not-yellow ones. We're trading those, right?" - Me, trying to remember what counts as Emerging Markets.

A Quick Explanation:

We're continuing our push for simple ideas and execution today with a new strategy that looks at Emerging Markets Equity ETFs.

I suspect that this strategy isn't complete, and that there's another ETF or concept that would make this a more full strategy. Perhaps European indices, volatility ETFs, or something else I haven’t considered yet. However, I think the returns were pretty decent as-is. We don't need completeness to make decent money, we just need to buy low and sell high.

A little while ago I read a paper on the hidden costs of rebalancing for ETFs and index funds. Because everything in the market has costs and tradeoffs, and the market is competitive, a fund that explicitly states when and how it will rebalance is likely to get front run by other market participants looking for a quick buck. The paper is "The Unintended Consequences of Rebalancing", found here for those who are curious.

When I was toying around with the assumptions of the author's model, specifically how bond and stock portfolios will rebalance when a return difference has been hit, I noticed something else happening in a completely different ETF. Depending on how TLT and SPY moved in a day, (return from prior close to current close) iShares MSCI's EEM ETF would react the next day.

The Effect:

- When SPY Close to Close returns for day t < TLT returns from Close to Close for day t, EEM performs well Close to Close for day t+1.

- When SPY Close to Close returns for day t > TLT return from Close to Close for day t, EEM performs poorly Close to Close for day t+1.

I can only guess why this happens. Maybe when bonds are outperforming/underperforming, managers will allocate more/less for emerging markets? I also suspect that there’s a more “complete“ version of this effect that can perhaps use EEM, SPY, commodities, bonds, etc. all at the same time. I’m thinking regime changes, portfolio mixes of multiple ETFs to balance out volatility, Hidden Markov Models, all sorts of stuff. But this is simple, so we’ll use it.

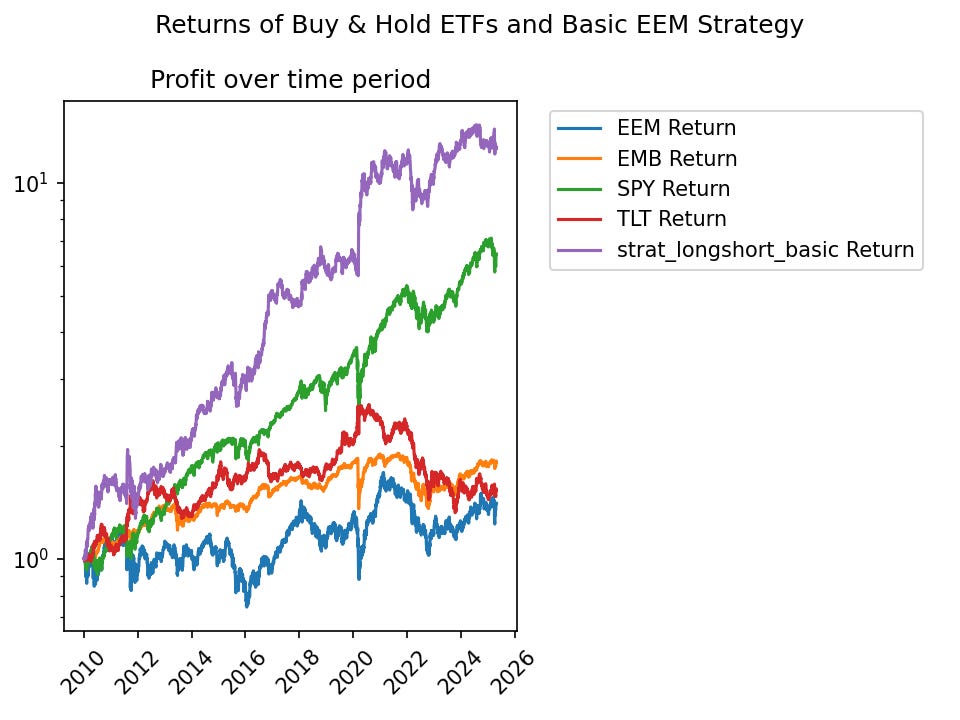

Note: We’re going to use a logarithmic scale on charts from here on out, because it can visually show continued outperformance of a strategy better than linear scale.

Since inception, EEM has underperformed compared to SPY. Even recently, EEM has a roughly 2.5% annual return for the past 10 years compared to SPY’s 12.2% percent for the same time period. But using this simple strategy outlined above gets returns comparable or better than SPY over time. I say comparable to SPY buy and hold because this strategy isn’t taking transaction and shorting costs into account. I imagine that shorting fees and trading expenses in 2005 were far higher than now, and vary across brokers. But EEM is a very liquid ETF, so the costs and bid-ask spreads should be as small as you can realistically get for shorting strategies.

I decided on using 2010-01-01 to 2025-05-01 as the comparison period for returns, for 2 reasons. First, Leveraged ETFs like SPXL and EDC did not exist until 2009, and so comparing returns for 2004 onwards for EEM versus 2009 onwards for EDC feel a bit like apples and oranges. Second, EEM and especially EEM using this strategy, had a massive bull run from 2008-2010 to the point where any visual or statistical comparisons would feel unfair for extrapolation of possible future returns. Feel free to try out the code linked at the end with a start period in 2005 to see what I mean.

The Potential Strategies:

The general rules are pretty much the found effect:

- At Close of market day, when SPY return < TLT return: Long Emerging Markets until close of next day.

- At Close of market day, when SPY return > TLT return: Short Emerging Markets until close of next day.

I'm trying to beat back my complexity addiction, but exploiting this anomaly gets interesting because we have access to short selling and leveraged ETFs:

- The main liquid underlying ETFs: SPY, EEM, TLT, EMB.

- Corresponding 3X intraday levered ETFs: SPXL, EDC, TMF (none for EMB though)

I'll show some potential strategies, preferences, and constraints, and the long-term returns.

Long Only:

For long-only, we can do Long EEM when the strategy says go long, and stay in cash or risk-free rate bonds otherwise.

These strategies can be used if we're unable or unwilling to short. And being in cash upwards of 60%-70% of trading days allows for them to be used in combination with other strategies.

Long/Short:

The most simple long/short strategy is to Long and Short EEM according to the general rules. This strategy makes money over time, but the daily movement between net-long and net-short might complicate balancing a full portfolio with other strategies.

I then found you can also do a long-short pair with TLT and make better returns over time. (Long EEM/Short TLT, Short TLT/Long EEM like with the general rules) An advantage to this strategy is that the Long and Short positions will balance each other out, so you can have a net-zero cash outlay. A disadvantage is that you'll need to pay shorting costs for EEM and TLT, but I imagine those costs are low and there shouldn't be any difficulty in locating shares to short for these liquid ETFs, especially for larger accounts. Exchanging TLT for EMB (the emerging markets bond ETF) in gives us lower returns, but a slightly higher Sharpe than EEM/TLT long-short.

Leveraged Long Only:

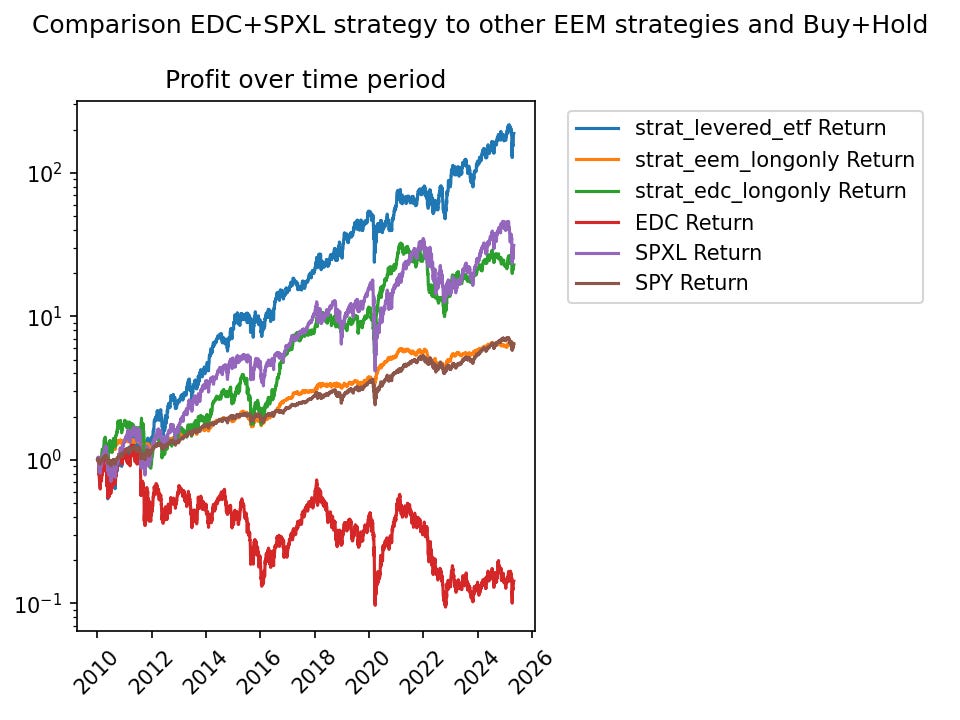

We can also use levered ETFs and hope that the gains and leverage will overcome volatility drag, since we’re unlikely to hold a leveraged ETF for long periods of time. Replacing EEM with EDC gets us predictably higher returns and drawdowns.

We can also try adding leveraged SPY exposure when we're not long emerging markets. For this, we use EDC when we go long Emerging markets, and long SPXL when we're going 'short' Emerging markets. This strategy has a really nice long-term trend on a logarithmic scale, but you can see the occasional sharp drops like in 2020.

There’s a “secret” other condition for the EDC+SPXL strategy that I found increased returns: not trading if at market close, the next calendar day is not a market day (holidays, weekends, etc). I suspect it’s from levered ETF decaying a little harder over the weekend, and it might be another inefficiency worth exploring in the future.

Decisions, decisions:

We see that each of the above strategies is preferable to buying and holding EEM long-term. Each strategy across a few time periods also will have higher Sharpe ratios and average annual returns than buy and hold EEM or EDC. Some even have a better Sharpe ratio and returns than SPY, ranging from 0.73-0.99 Sharpe compared to SPY’s 0.62 .

When we compare the strategies with each other, we have to make a decision on the risks and costs to take. Long-short strategies have better risk-adjusted returns, lower drawdowns, and a net-zero position size, but shorting costs could be a large enough of a drag to make them worse going forward than long-only or levered long-only. Long-only and leveraged long only strategies are profitable over time and consistent, but endure larger drawdowns, and may be less liquid than the larger un-levered ETFs.

Personally, I'm going to try investigating the EEM/TLT Long/Short strategy and the simple long-only EDC+SPXL strategy. Starting this Monday, I'll be running TLT/EEM with a 10% position sizing. I’ll track it for a month or so and see how the costs and returns look. If shorting is too expensive, or constantly switching between long and short TLT and EEM causes too much friction, I may switch to the long-only EDC+SPXL strategy, also at 10% position sizing.

Code for the backtests and analysis is listed [here].

- Lay Quant

Thank you for this. I am also going to look into this!