“My father worked at a bank. They caught him stealing pens.” - Rodney Dangerfield

There’s a lot of talk ramping up about the Fed lately. To cut, not to cut, abolish, not abolish, what Jerome Powell’s up to behind closed doors… It’s hard to keep track. So this article is going to be boring and completely sidestep any political, news-related, or economy-related commentary on the Fed, its purpose, and its effectiveness. Sorry if you were hoping for that discussion here.

Normally my trading strategies avoid FOMC days, especially the ones using options. The FOMC mornings are tense and stagnant, and then the afternoons often have wild volatility and an unpredictable end to the day. Such days function like event-driven binary outcomes on the market, extremely up or down based on something released at a set time. It's like a planned read out for a drug trial or lawsuit… Where I often lose.

I studied economics in college, and was even interested in macroeconomics and interest rate policy, but I learned quickly that I was a terrible macro trader. Predicting what the Fed was going to announce, and the effects of those announcements one month or even one day afterwards was a fool's errand for me.

So I figured it was prudent to not waste money and time trading during FOMC days.

Okay. But.

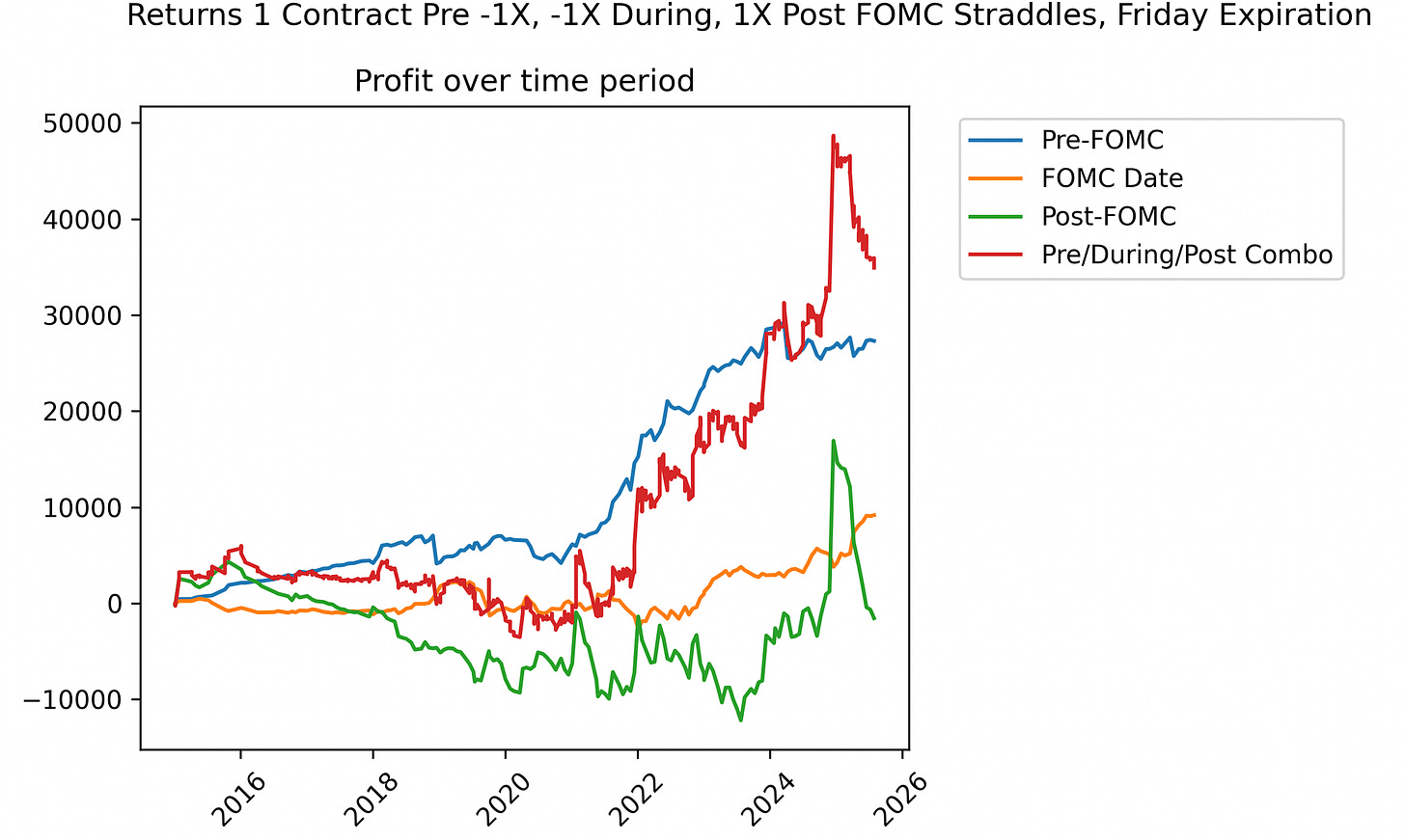

Recently I found a paper on trading Volatility around FOMC meetings (Post-FOMC Drift in the Equity Options Market), and I decided to look into it more. The paper's authors found that going long Volatility (an SPX straddle, for instance), the during market hours the day after an FOMC decision made a statistically-significant 1% return, as opposed to the statistically-significant -1% return for normal days like the day before an FOMC meeting. The reasoning from the authors is is that volatility contracts in advance of an FOMC meeting, and then expands after the day after an FOMC meeting as market participants battle out heterogenous views on whether the market is bullish or bearish. Sounds kinda simple.

For those unwilling to do a quick Google, here's a quick summary of FOMC meetings:

The Federal Open Markets Committee, a dozen economists, meet to discuss the economic outlook for the country for 2 days. Then they make a decision on what the interest rate for the Federal Funds Target Rate should be.

These meetings happen roughly eight times per year and are planned well in advance.

The setting of this interest rate has far-reaching consequences for the US economy, stock market, interest rates, and even the world economy.

After the decision is made the Chairman of the Federal Reserve will do a press conference at around 2PM to discuss the results and take questions.

Sometimes the FOMC has emergency meetings, but those meetings are not of interest.

Three weeks after an FOMC Meeting, a summary of the Minutes to the meeting are publicly released as well. Usually in the afternoon.

With the proliferation of options, hedging and speculating on FOMC event days has become popular. The implied volatility and volume for options on FOMC days is thus often rather large.

(Pictured below: a wild JPow in his natural habitat)

Okay… I’m not the only person investigating FOMC effects

Not by a long-shot. There’s probably hundreds of articles about the wide-ranging market changes FOMC days have had. A few effects that other people found include:

This article by QuantSeeker about trading on FOMC days shows abnormal returns from just going long SPX from market open until a few minutes before the FOMC release.

The above-mentioned Long-Volatility Straddle trade the day after FOMC meetings.

Bond Funds have abnormal Net Asset Value (NAV) movement on the day of FOMC meetings.

FOMC events themselves have large positive effects on the stock Market.

The Federal Reserve itself is a large research body with talented economists on staff who study the economy in detail and frequently post interesting research papers for public consumption.

After pulling FOMC dates from the Federal Reserve's website, and some simple backtesting with Polygon Data from 2015 onwards, I think that the authors of the Pre/Post FOMC dates paper were onto something. The intraday returns for SPX straddles get a little weird Pre- and Post- FOMC dates.

In addition, I've noticed the following:

The release of the FOMC Meeting notes (set to 3 weeks after each FOMC decision) can also be a profitable trading setup for the same Long/Short volatility trade. This doubles the number of viable trades for a system created to trade this strategy. We now have 3 (pre/during/post) * 8 (set FOMC meetings) * 2 (Minutes and Meetings dates) = 48 potential trading days each year.

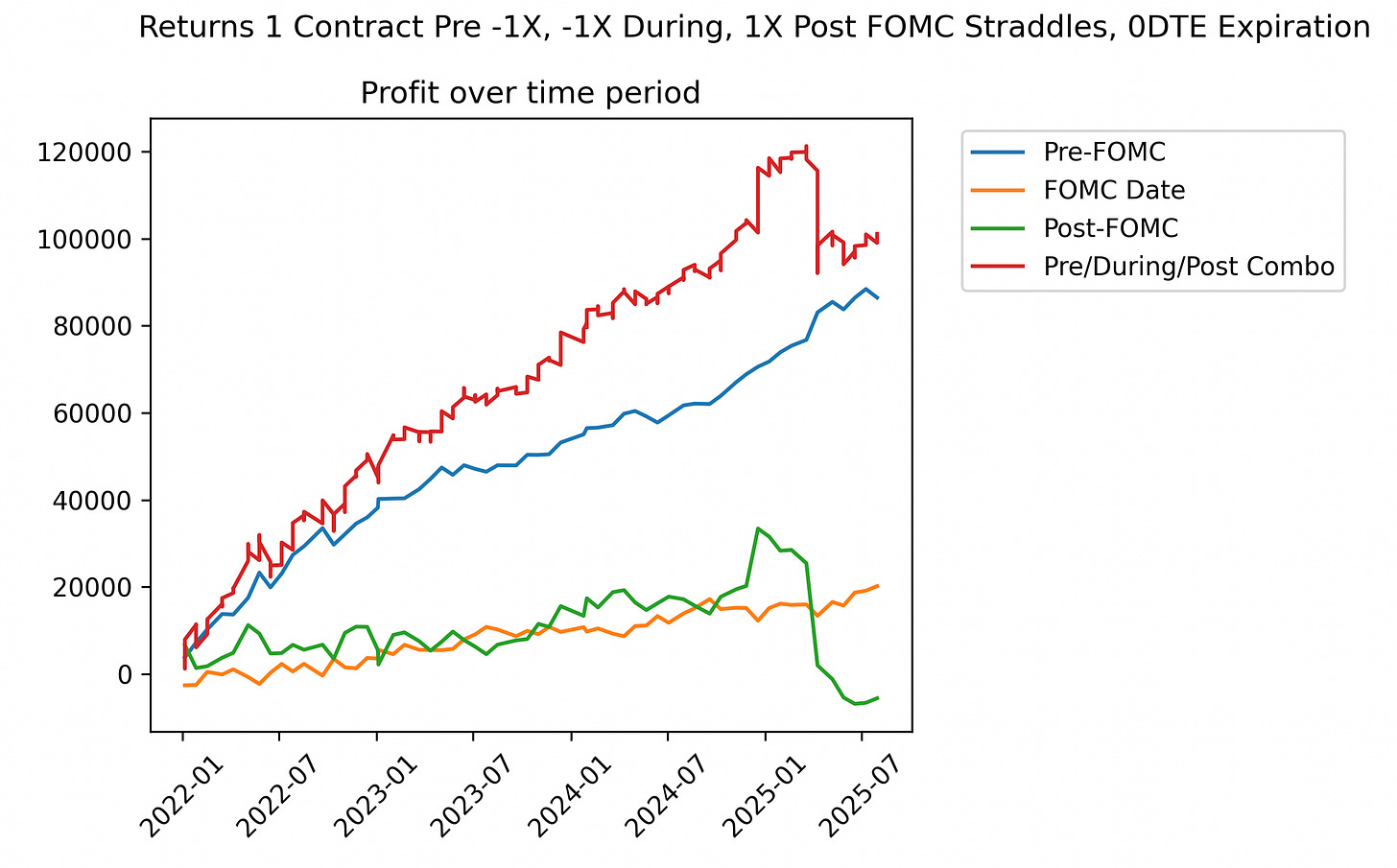

With the creation of 0DTE options, selling volatility intraday one day before an FOMC release since 2022 is very profitable. In fact, "day-before" Volatility selling is more profitable than the other 2 dates combined, and with lower return variance.

Buying out-of-the-money long calls and puts can greatly reduce return variance for the short straddles, making them Iron Butterflies. Personally, I never, ever do short-option-only positions. The prospect of unlimited losses is terrifying.

Anecdotally, I've noticed that option premium decay is stagnant during FOMC release dates. It's possible that a day-long short-Vol trade could instead be a 1-2 hour trade starting a few minutes before 2PM.

The Option strategies look promising at first glance, especially going short Volatility the day before the FOMC.

Okay, but these look IFFY. Can we see other Volatility possibilities???

Just before I was about to throw the final draft for this article into Substack, add in some zesty memes, and click send, I got an idea: Shouldn't all this FOMC volatility mess with the Volatility ETFs we've been trading as well? The volatility ETFs are holding combos of VX futures, not 0DTE options, but those should still move a bit in reaction to the Fed.

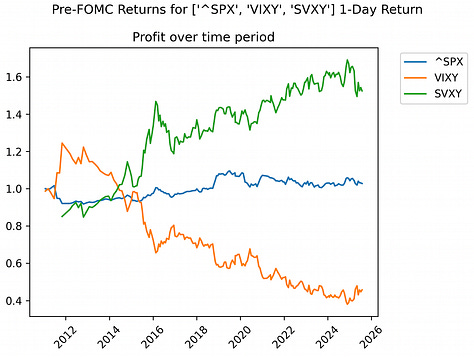

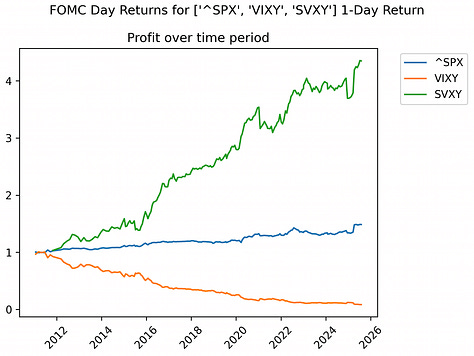

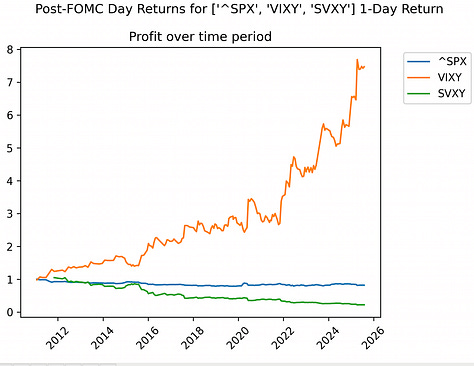

So I threw some quick code together using the exact same FOMC dates, as well as the pre- and -post trading days. As it turns out, being short Volatility for 24 hours Pre-FOMC day and FOMC day, and then long Volatility for 24 hours Post-FOMC release is quite profitable.

These trades will likely override the VIX1D trade signals I've been using for the Volatility Reversion Trade, since the percentage of profitable trades and Sharpe's for both SVXY and VIXY are high (> 2 for FOMC dates and Post-FOMC dates, respectively.)

I was pleasantly surprised that the post-FOMC day VIXY trade works as well as it does, since VIXY is a messy, messy ETF that decays over time.

Okay, but what are we actually trading now???

As it turns out, this upcoming week will have an "FOMC Date", on August 20th. I'd be lying if I said I planned it all out this way. Unfortunately, I'm going to have to trade the option strategy on my TradeStation simulated account for now, because the amount of margin needed per SPX contract is a too bit high. The SVXY/VIXY ETF strategies will be traded at a 10% position size, however. If the backtesting results hold up going forward, I’ll likely trade a Short SPX or SPY Iron Butterfly Pre-FOMC, then the Volatility ETFs for the FOMC and Post-FOMC days.

The Option strategy will be following:

For both FOMC Minutes and FOMC Meeting dates.

Options used are SPX that expire the same day. (0DTE)

Pre- and During-FOMC dates, I sell an Iron Butterfly at the market open. An at-the-money Call and Put are sold, and then an out-of-the-money Call and Put are bought.

Post-FOMC dates, I buy a Straddle at the market open, meaning I buy an at-the-money Call and Put.

The trades are closed at the end of the day.

The ETF strategy will be the following:

For both FOMC Minutes and FOMC Meeting dates.

Use SVXY and VIXY ETFs, 10% position size. Will override the Volatility Reversion trade if there’s a conflict.

During-FOMC dates, go long SVXY from prior Close (t-1) to Close of that day (t)

Post-FOMC dates, go long VIXY from prior Close(t-1) to Close of that (t)

Ok, gimme some code to mess with myself

I've included backtesting code at the end to analyze the trading results for the option strategies, with some adjustable variables. And I’ve included lists of prior FOMC dates, going back to 2005, as well as links where current and future FOMC dates will be posted.

Options:

Pre/During/Post/All Combined Analysis.

The trades look at returns for both using 1 Contract each time, and for selling a set amount of premium each time.

Trades (by day Pre/During/Post) can be either Long/Short Volatility, meaning the Straddle is Long/Short.

Trades (by day Pre/During/Post) can also use long calls and puts to become Iron Butterflies, which removes the infinite risk potential for the Short Vol trades. The call and put wings are determined by the size of the VIX, and can be adjusted to be larger or smaller as a multiple of the size of the VIX.

The Option expiration used can be either the closest Friday (good for 2015-to-now analysis) or 0DTE (good for 2022-onwards analysis)

Volatility ETFs:

Intraday + Close2Close returns.

Pre/During/Post

Time period can be adjusted.

Can also see SPX's returns.

Here is the code repo for investigating FOMC trades in options and Volatility ETFS.

- Lay Quant

Since VIXY had pretty good consistence returns, why not use UVXY (1.5x leverage) or UVIX(2x leverage). Yes, the risk is higher, but wanted to hear your thoughts.