Trading Leveraged Bond ETFs

“Never make forecasts, especially about the future.” — Samuel Goldwyn

This post will be kind of short and simple.

I'm a bit dumb and didn't know that Bonds had their own Volatility Index (^MOVE) until this month. So I spent the past week or so playing around with it to see if it had signals that could be used. I know there's a lot of talk about using bonds in a portfolio, but we've been in near-zero rates for so long I still don't believe the current 5%+ Treasury rates are actually real numbers.

Anyway, the MOVE index is a volatility index originated by Morgan Stanley and now owned by ICE, that takes into account option prices on various treasury maturities to gauge the implied volatility of the bond universe. I'm still looking to find a paper that explains how it's constructed like how the CBOE explains the VIX and VVIX, but I'm guessing it uses roughly the same methodology the VIX does.

Anyway, finding out about the ^MOVE index made me wonder: Can we accurately predict bonds and bond funds given the volatility? More importantly, is there a pattern that can be exploited?

Normal TLT trading, over even buy+hold, isn’t that interesting. And leveraging up with a buy and hold strategy (TMV, TMF) appears to be a recipe for disaster:

I'd like to say I found a cool Machine Learning algorithm or used some brilliant statistical method to find a hidden pattern, but I didn't. I saw the basics for this on Quantified Strategies’s site listing some free trading strategies.

The trade is simple, but still I'm kind of hyped about it.

For whatever reason, at the start of the month (let's say the first 5 trading days), people will maybe sell their bonds, depressing prices, which then gets reflected in TLT, the largest US Treasury long-term bond ETF. And then they'll get bought up on other days, increasing prices.

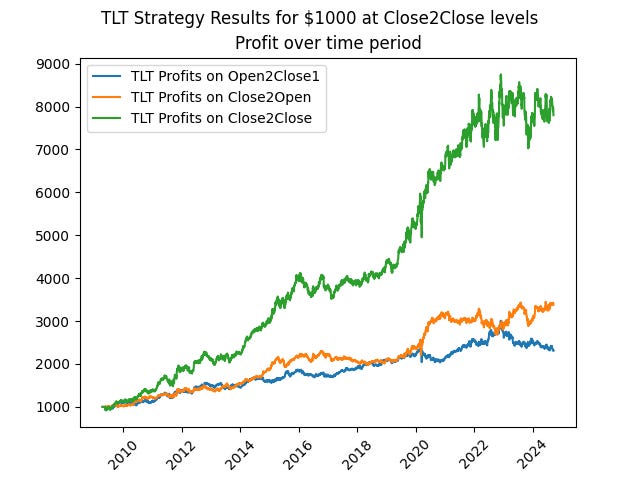

So if you Short TLT the first 5 trading days of each month, and long the other days, since TLT's inception, you'd make a nice ~600% return since 2009.

Of course, I wanted to do a little better. Certainly there were days it's smart to assume TLT will go down in a "Long" period, and up in a "Short" period, right?

I tried several metrics, like raw ^MOVE levels at market close, prior returns, futures, and the VIX, with varying success.

It turns out the best additional metric I could find was the 20-day relative strength of closing prices (RSI-20) for /ZN=F, the Front month of the 10-year Treasury Futures Contract. My assumption for why it works is because /ZN is also used by institutions for hedging/speculation, their users might be more sophisticated than TLT's.

Anyway, so we now have the following rules, none of which take into account TLT’s actual price or value:

TLT trading Rules:

Long: /ZN=F Close Price RSI-20 < 80 while on or after the 6th trading day of the month.

Long: /ZN=F Close Price RSI-20 < 20 while on or before the 5th trading day of the month.

Short: /ZN=F Close Price RSI-20 > 20 while on or before the 5th trading day of the month.

Short: /ZN=F Close Price RSI-20 > 80 while on or after the 6th trading day of the month.

Which lead to the following returns using TLT, a respectable ~700%+ raw return:

(Note that 80 and 20 are RSI thresholds I found with good returns, but the strategy still worked increasing or decreasing them by roughly 10 points. 70-30, 90-10, etc.) The point of the RSI limits is to avoid buying/selling into an overbought/oversold trend.

Complicating things, and Leverage:

So that's all well and good, but bond funds don't really move that much, short interest might be expensive and risky, or our broker might not even allow us to do short. Maybe we can find a reasonable solution for leverage with fewer headaches?

Enter TMF and TMV, The Direxion Daily-Rebalanced 3x Bull/Bear ETFs for 20+ Year Treasury Bonds. Rebalanced daily. These securities track 3X the daily performance of the TLT using derivatives. This means for a "Long" position we can go Long TMF shares, and for a "Short" position we can go Long TMV. Since we're not necessarily holding each one for long periods of time, the long-term drag from the ETF’s daily rebalancing shouldn't hit too hard. But as we can see below, “choppiness“ in returns could hurt.

The returns speak for themselves, if you could stomach the recent 2 year's volatility and plummets. A greater than 10,000% return over 15 years.

…Okay, yes, the chart is nice, but why the insistence on a long-only equity strategy? Why am I interested in this trade?

The strategy uses leveraged ETFs that have zero commissions with some brokers, and the strategy doesn't require margin, futures, or options. So it seems possible to trade this strategy daily from a tax-advantaged account like a 401k or Roth IRA, and not pay much in commissions, fees, or taxes. In theory. Also, since you're at most trading once at the close of each day, you won't hit any Pattern Day Trade restrictions. There shouldn't be a lot of slippage either, since when I checked today TMV, TMF, and TLT all have roughly $0.01-$0.02 Bid-Ask spreads. If one’s worried about trading too much and slippage, the most basic TLT strategy should only require 2 trades per month from longing to shorting TLT.

The question I’ve been asking myself:

So, there’s a decent amount of trading alpha, a simple strategy, possibly no taxes, minimal commissions or fees in an account that can’t otherwise do complicated trading. Why don't more people do a TLT strategy like this? Why has the alpha persisted? I don't know, asides from the fact that there can be choppiness and underperforming periods of 3+ years.

I suspect this trading strategy could be further optimized to handle 2+ year “chop“ periods, perhaps using data from the Fed on interest rates, or volatility to avoid large downturns.

But I'll still try the TMF/TMV Long trading strategy out for myself soon, once I free up some cash in my Roth account. I think the strategy should still work well enough over the long term.

Code for the TLT, TMF/TMV trading strategy is here.

Trading for the other strategies is trudging along. I'll have an October 1st update posted soon detailing what happened and any changes to the code.

- Lay Quant