August 2025 Update, and a Vibe-Ridden SPY Strategy

“If I had my way, I’d remove January from the calendar altogether and have an extra July instead.” – Roald Dahl

Updates:

We're doing okay this month, maybe. I had mixed results, but hopefully next month will be better. I've got another sorta-ORB Long Call trade I’m going to share at the end, but first we're going to look over this July’s results and discuss a bit what worked and didn’t work trading my own strategies.

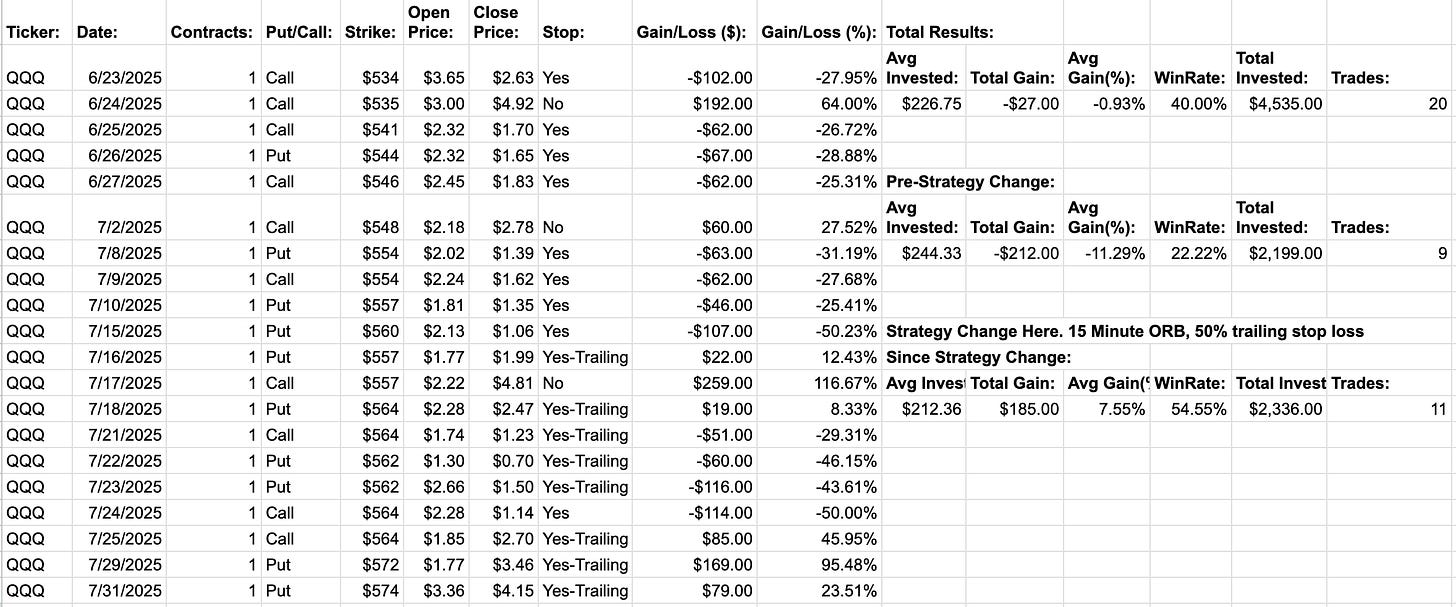

QQQ ORB Update:

After the ORB change, there's been an improvement in the QQQ ORB trade results. I'm actually sorta profitable! Net gain with the new strategy is $185, reducing total losses since ORB inception to only -$27. Less quantifiable is the lower stress and annoyance when I close a trade for a profit instead of watching it swing to a loss that gets stopped out. Hopefully over time this strategy will prove itself and I’ll be able to increase the position to a 2-3% size of the portfolio.

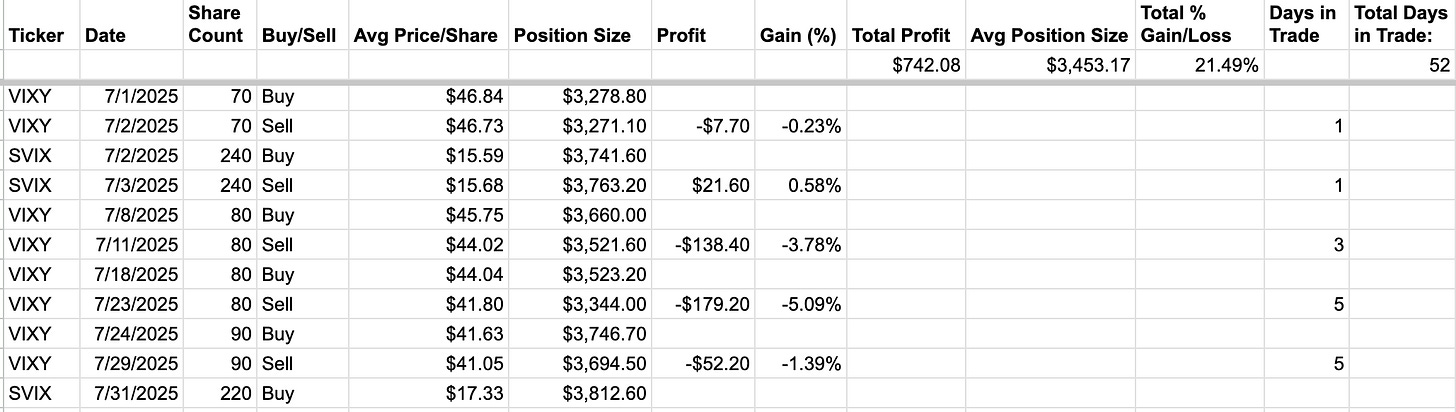

Volatility Reversion Update:

As good as last month was for the Volatility Reversion trade, this month’s Volatility trading was about half bad and much more annoying. The month seemed to just be a slow bleed from trading VIXY as the S&P 500 marched higher and VIX1D flipped above and below 10 every few days. The result was a loss of -$355.90. But it could have been worse? Maybe August will be a bit more volatile, and the newly-opened SVIX position will save the day.

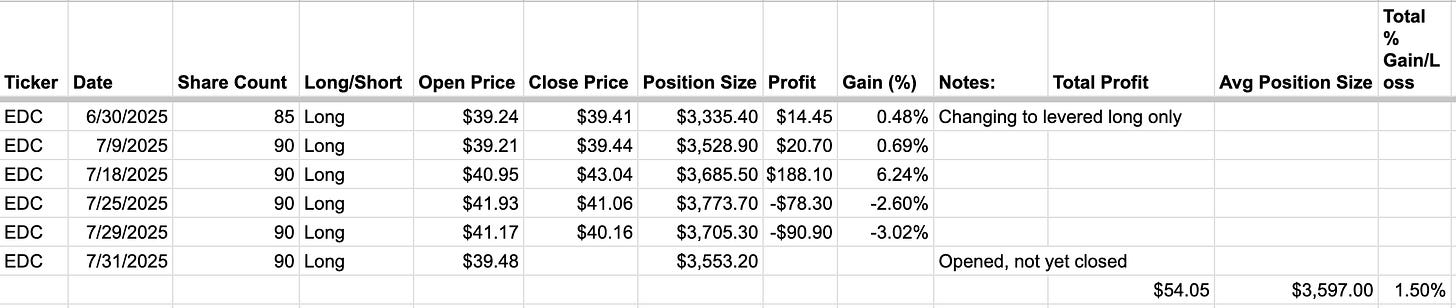

Emerging Markets Trade Update:

After the EEM/TLT strategy switch up, I'm making a little money now and spending less time each day fretting about opening and closing long/short positions. It’s a nice change of pace. The EDC-long-only trade has made $54.05 since 6/30/2025, allowing me to climb a bit out of the hole created by the EEM/TLT trade losses and shorting costs.

SPX 4-Minute Trade Update:

There haven't been trades that qualify at the 2-Standard Deviation Level since I posted the SPX 4-Minute Trade article on 7/20/2025. Which is awkward. There were a few 1-Standard-Deviation Level moves, but nothing that made a large amount of money. Either the 3:50-minute move was too small or in the wrong direction. Better luck next month?

TMF/TMV Trading Update:

July's TMF and TMV trades, detailed in the strategy revisit post here were both profitable. And since SPY's 1-month return was > 0, I opened a TMV trade today that will be closed August 7th at end of day. Two buys, two sells. Both profitable and with no fuss. If only every trade I did was like this.

Another Long Option Trade, and ‘Vibe’ Trading

For the past few months I've been trading Tuesday+Friday Long calls on SPY, with some rules… and then some Vibes with a capital ‘betrayal of the the entire concept of quantitative trading‘. And I’m going to add a minor tweak to the strategy. Here’s the strategy overview:

Weekday must be Tuesday or Friday

VIX must be down from prior close at 9:31AM

Buy up to $1000-worth of SPY Calls

The Calls are around a 0.70 Delta. (or about 2-strikes below SPY’s price)

The trade has a 25% stop loss.

The trade is closed out at 3:55PM.

The reasoning this should be successful is that Tuesdays and Fridays tend to have trending up days, especially if VIX drops on the open... Kinda like the ORB trade. I keep position sizing to $1000 or less each trade, to make the bet a small one. And... there's not much more than that?

The reasoning for why this Tuesdays and Fridays trade should work is the following:

Tuesdays have a “Turnaround Tuesday Effect“ sometimes, where Tuesday intraday returns do well when Monday and Friday have had losses.

Friday is because of either end of week flows or weekly option expirations driving purchases and hedging.

Since we’re hoping for a trending day, we don’t need to sit and watch the Call option premium go to zero. A 25% stop loss should prevent horrific losses.

VIX dropping on the open should mean that the market isn’t expecting SPY to drop, and options are less expensive.

The backtests looked good, both on OptionAlpha, and my own code, a variation of the modified QQQ ORB post's code. I found that testing Monday, Wednesday, and Thursday got bad results to the point of only making $1000 over 3 years, along with trading when the VIX from the prior close is > 0, which lost money.

Anyway, using my slapped-together code to backtest this strategy a little more, I found that opening the trade when there’s a drop in the VVIX at 9:31AM instead of the VIX works a little better than what I’d had before. So I’ll be switching to using VVIX instead of VIX as a trigger. Surprisingly, I found that perfectly mechanical 25% trailing stops did not outperform the initial mechanical 25% stop I’d had on OptionAlpha, both for VIX and VVIX trades.

Now, to the ‘Vibes’. My trades so far have been profitable for this SPY strategy... but I often do a manual close out of the trade early for a profit based on the feel for the market that day. I don't like or understand it, but it’s working so far. If the trade is up, say, 40% early in the day and looks like it’ll dip, I might just close it out. Due to the small number of possible trades per year for this strategy, I won’t know for another year or two whether this is was good idea.

Still, I'll add this to the list of trading strategies I talk about each month in future monthly updates. Here are the SPY Tuesday+Friday trades since strategy inception.

That’s all for now. Here’s a link to the backtest for the SPY Tuesday+Friday code.

- Lay Quant